PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a. Chapter I PRELIMINARY Short title 1.

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

PUA 2782015 provides that any tax and stamp duty payable under the Income Tax Act 1967 ITA and Stamp Act 1949 respectively shall be remitted in full in respect of any agreement note instrument or document in relation to the Sukuk Murabahah Programme ie.

. Tax Rate of Company. Introduction Individual Income Tax. Objective The objective of this Public Ruling PR is to explain the types of buildings that qualify as industrial buildings under Schedule 3 of the Income Tax Act 1967 ITA.

22 August 2016 Page 1 of 44 1. Khamis Mac 10 2016 INCOME TAX EXEMPTION A. OF THE TAX 3.

INLAND REVENUE BOARD OF MALAYSIA GROUP RELIEF FOR COMPANIES Public Ruling No. Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published. Gains or profits from a business arising from stock in trade parted with.

52 The income of a seafarer from employment exercised on board a ship operated by a person who is not resident in Malaysia is deemed not derived from Malaysia. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. Incorporated under the Companies Act 1965 are required to file the audited financial statements to the Companies.

23 November 2016 Page 1 of 14 1. The Intellectual Property Corporation of Malaysia Act 2002 the Geographical Indications Act 2000. 22 The provisions of the ITA related to this PR are sections 2 7 and 8 and Schedule 3.

1 This Act may be cited as the Income Tax Act 1967. 24 rows Tax Relief Year 2016. Responsibilities Rights of Individual.

PDF uploaded 1102018 5. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. 62016 Date Of Publication.

Income Tax Act 1967 Kemaskini pada. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate. ChApTER I PRELIMINARY Short title 1.

On 23 November the Inland Revenue Board of Malaysia issued Public Ruling PR No. An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967 the Sales Tax Act 2018 the Finance Act 2010 and the Finance Act 2018. Tax Act 1990 instead of the Income Tax Act 1967 ITA.

Relevant Provisions of the Law. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Tax treatment of gratuity.

ENACTED by the Parliament of Malaysia as follows. Contents 1 Corporate Income Tax 1 2 Income Tax Treaties for the Avoidance of Double Taxation 5 3 Indirect Tax 7 4 Personal Taxation 8 5 Other Taxes 9 6 Free Trade Agreements 10. 82016 Date Of Publication.

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. An Act to amend the Income Tax Act 1967 the Petroleum Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Labuan Business Activity Tax Act 1990 and the Goods and Services Tax Act 2014. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia.

Tax relief refers to a reduction in the amount of tax an. 82016 to explain the types of buildings that qualify as industrial buildings under Schedule 3 of the Income Tax Act 1967 ITA for capital allowance purposes. Income Tax Act 1967 ITA through the Income Tax Rules ITR made by the Minister of Finance.

Except for those interest that fall under subsection 245 of the ITA. 62 Taxable income and rates 63 Inheritance and gift tax 64 Net wealth tax 65 Real property tax. Under the Labuan Business Activity Tax Act 1990 instead of the Income Tax Act 1967.

Hence the income is subject to tax in Malaysia. Tax Treatment Interest income is chargeable under paragraph 4a or 4c of the ITA. ENACTED by the Parliament of Malaysia as follows.

Non-chargeability to tax in respect of offshore business activity 3 C. Objective The objective of the Public Ruling PR is to explain the tax treatment of group relief for companies which are resident and incorporated in Malaysia. Classes of income on which tax is chargeable 4 A.

Eligible for partial exemption of RM9k the balanced 91k is taxed in the year of receipt. Non-business income 4 C. Procedures on Resignation of Secretary under Section 237 of the Companies Act 2016.

ENACTED by the Parliament of Malaysia as follows. Exemption of RM 1k for each complete year of service on gratuity payment. INLAND REVENUE BOARD OF MALAYSIA INDUSTRIAL BUILDINGS Public Ruling No.

This Act may be cited as the Finance Act 2017. Income tax in Malaysia is imposed on income accruing in or derived from. FINANCE ACT 2021 An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967 the Labuan Business Activity Tax Act 1990 the Promotion of Investments Act 1986 the Finance Act 2012 and the Finance Act 2018.

Companies Act 2016. The Inland Revenue Board of Malaysia IRBM is one of the main revenue collecting agencies of the Ministry of Finance. Companies Act 2016.

Special classes of income on which tax is chargeable 4 B. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. Charge of income tax 3 A.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is exempted at statutory levelThe quantum of tax exemption on statutory income varies between 70 and 100 for a. Relevant Provisions of the Law.

From the year of assessment 2013 section 4B of the ITA provides that interest income cannot be charged to tax as gain or profit from business under paragraph 4a of the ITA. Queries Issued on Documents and Applications Lodged with t he Registrar. Tax Espresso - January 2016 26 February 2016.

Ella work for 9 years retired at 60 gratuity of RM100k. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income. This Act may be cited as the Finance Act 2019.

YA 2015 YA 2016 Chargeable Income RM Rate Tax Payable RM Rate Tax Payable RM On the first On the next 5000 15000 1. A Labuan entity can make an irrevocable election to be taxed. PR 82016 covers several buildings types and provides examples of their qualification as an industrial.

PDF uploaded 1772019.

Tips For Income Tax Saving L Co Chartered Accountants

Tax Guide For Expats In Malaysia Expatgo

Tax Guide For Expats In Malaysia Expatgo

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Malaysian Income Tax 2017 Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Tax Guide For Expats In Malaysia Expatgo

Differences Between Enterprise Sdn Bhd For Business Owners Foundingbird

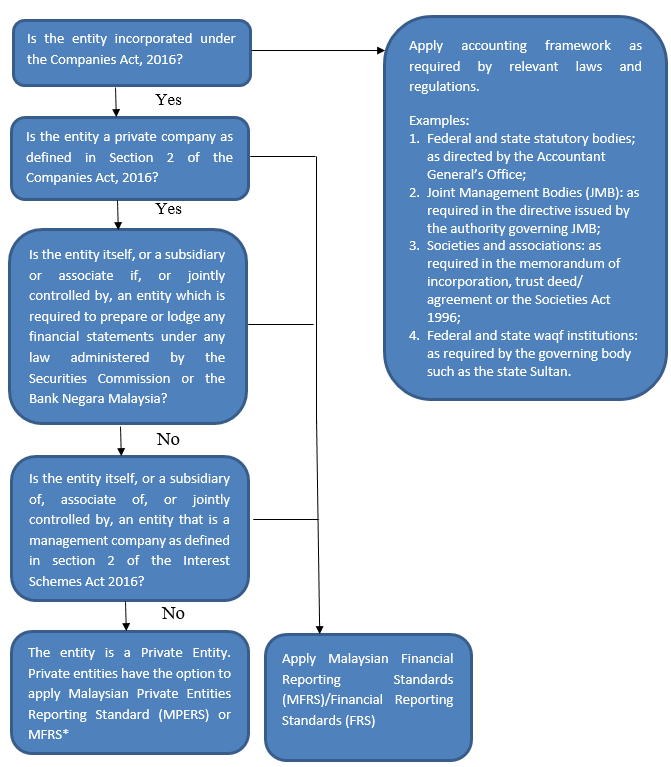

Accounting Standard L Co Chartered Accountants

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

In The Matter Of Interest Crowe Malaysia Plt

Why Proper Record And Document Keeping Is Important To A Company Law Of Malaysia Act 777 Companies Act 2016 Section 245 Asq

Malaysia Payroll And Tax Activpayroll

2017 Personal Tax Incentives Relief For Expatriate In Malaysia